Understanding CA Prop 19

Understanding CA Prop 19

Benefits for homeowners & how this changed property taxes

If you purchased your home more than 5 years ago, you likely have a good deal of money in equity now. Additionally, due to the purchase price of your home, your property taxes are significantly lower than they would be if you purchased your home again today. While some people can and prefer to stay in their homes forever, for others it makes sense to sell their property and move elsewhere.

Many people find they would like to live closer to family and loved ones once they don’t need to worry about working and commuting any longer. Others don’t want to take care of their large home once the kids are no longer living there. I’ve also seen people make exciting plans to travel the world and leverage their home’s value to fund their new lifestyle.

Prop 19 can help with all of these goals if you qualify. Take advantage of your new property tax benefits when you transfer your tax basis!

How Prop 19 impacts the taxes on the properties you have inherited:

If you have recently inherited a home, or you will soon, under Prop 19 the property taxes will increase to match the property’s current market value.

To avoid the increase in property taxes at the inherited property, you have 2 options:

-

- Within 1 year of transfer, live at the property as your primary residence and file for the appropriate exemption.

- Sell the property.

For additional information about how Prop 19 works please email me: jacquie@davidlyng.com

Jacqueline Van Metre

REALTOR, GREEN

David Lyng Real Estate

DRE 02015151

Glow-Up your Garden

Glow-Up your Garden this Spring

Considering a spring garden makeover?

According to a recent Zillow article: “Backyards are Zillow’s must-have home feature for 2023. The humble backyard, once overshadowed by chef’s kitchens and walk-in closets, is the new luxury for today’s home buyers. Backyards are now highlighted in 1 out of every 5 Zillow listing descriptions. Mentions of patios and pools also surged, up by more than 13% and 11%, respectively, in 2022.

According to a recent Zillow article: “Backyards are Zillow’s must-have home feature for 2023. The humble backyard, once overshadowed by chef’s kitchens and walk-in closets, is the new luxury for today’s home buyers. Backyards are now highlighted in 1 out of every 5 Zillow listing descriptions. Mentions of patios and pools also surged, up by more than 13% and 11%, respectively, in 2022.

“The rising popularity of outdoor features suggests the pandemic has changed the way we want to live for good, priming the backyard for a 2023 evolution,” said Amanda Pendleton, Zillow’s home trends expert. “When the pandemic forced all entertaining outdoors, homeowners reclaimed their backyards from the kids or the dogs. Now they’re rethinking how that space could serve as an extension of their home in new, creative ways.”

In 2023, look for outdoor home gyms, natural pools alive with plants, edible gardens, and outdoor rooms for dining, lounging and quiet reflection.”

Whether you plan to sell your home in the near future or not, this is great news for those who want to spruce up their outdoors spaces. And spring is the best time to do it!

As gardens mature, they require revisiting from time to time. Sometimes plants fill in and look fantastic, other times they overstay their welcome and need a little pruning or even replacement. Sometimes plants just don’t do well where we plant them, perhaps they need a little more sunshine, maybe they need a little less. Other times you may do a bit of planting with the best of intentions and they simply didn’t take off like you thought they would.

Every garden is different and in the many micro-climates of Santa Cruz County, it’s common to need to revisit your garden space every season or at least every year at a minimum. Whether you’re prepping your home for sale, want to make the most of the space you have or you just want to shine in your neighborhood.

Read on for some great tips before sprucing up your spring garden.

1. Drought Tolerate Plants

Consider replacing some of your more water-thirsty plants with drought tolerant plants. This will benefit your water bill, but the natural resources in Santa Cruz County as well. Mulch can provide much-needed protection for your plants and requires no water, win-win! Compared to the popular, yet extremely water thirsty and demanding landscaping material, grass. Grass is definitely out, ground cover and mulch is in.

2. Raised Garden Beds

Take advantage of that sunny spot in your yard by adding raised garden beds. Homemade or purchased at the store, raised garden beds have grown in popularity over the years. Why are they so popular? They are excellent back-savers and help keep the gophers out too. Many of my clients light up when we tour a home that has raised garden beds ready to go. People love to garden at home to produce their own vegetables to use in their everyday life. These can be used for flowers and veggies as well as repurposed seasonally.

Take advantage of that sunny spot in your yard by adding raised garden beds. Homemade or purchased at the store, raised garden beds have grown in popularity over the years. Why are they so popular? They are excellent back-savers and help keep the gophers out too. Many of my clients light up when we tour a home that has raised garden beds ready to go. People love to garden at home to produce their own vegetables to use in their everyday life. These can be used for flowers and veggies as well as repurposed seasonally.

Looking for a little help? My friend, Courtney at Quaintrelle Farms does this for a living! Along with providing floral arrangements for events and her subscribers, she offers a service called The Garden Club. “Get started on your vegetable or cut flower garden with a program designed to help gardeners get the most out of their season!”

Learn more about Quaintrelle Farms here: www.quaintrellefarms.com

3. Do your Research

Figure out where in your garden spaces you have the most sunshine throughout the day. South facing yards are going to get the most sunlight throughout the year, while north facing will likely be best for shade loving plants. Incoming western sunlight (during the warmer afternoons) is different from eastern sunlight (during the cooler mornings). Once you know where your light is what gets sunshine and what doesn’t you can work with a gardening expert to decide which plants should be planted and where they’ll thrive

4. Curb Appeal

Create a welcoming look to your home when renovating your front yard. Think about seasonal blooms. While summer and spring are popular months for outdoor florals, some plants stay green and bloom year-round! Consider vines on your fences to brighten your space and weathered grey fences. Look into winter blooms that do well in the cold weather, which can create a very welcoming entrance and can even produce great cut flowers that you can bring inside too.

5. Upkeep

One easily overlooked feature of backyards and gardens, is the maintenance. Maintenance includes everything from, mowing, trimming, pruning, harvesting, re-potting, watering, mulching, composting, fertilizing, raking leaves and beyond. Tasks can really add up! Anything you can do to minimize the maintenance of your property will not only enhance your property’s appeal to buyers, but believe me, you’ll thank yourself in future years for the least amount of work that you have created for yourself too. Currently, beautiful gardens and backyards are especially desired by Buyers; however, a new homeowner’s life naturally becomes busier and busier over time and family expansion, so keep in mind of how much maintenance your garden and backyard are going to require, especially if you are preparing to put your home on the market soon.

6. Be Intentional

Plants and garden features are not only beautiful, they can be used to highlight or hide a space quite well too. Highlight a walkway or a corner sanctuary to lure your eye. Vines and shrubs can help hide unsightly things from your field of vision when planted and trimmed strategically. The use of lattice with an evergreen vine can easily mask a view of your neighbor’s home/window/yard, providing you with more privacy. I’ve seen lovely, modern screens with plants installed around utility equipment as well.

Be creative and be intentional in your spaces.

Jacqueline Van Metre

REALTOR, GREEN

David Lyng Real Estate

DRE 02015151

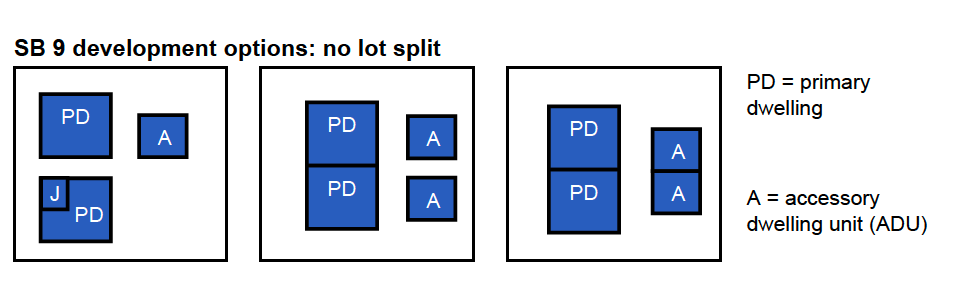

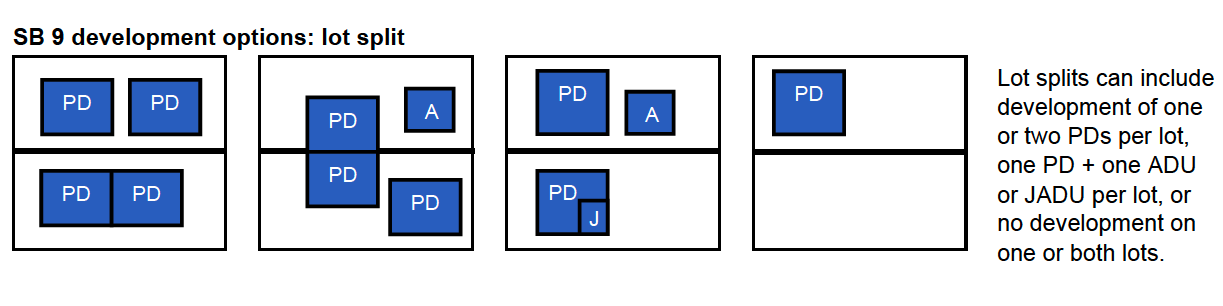

2022 New CA Law: SB9

2022 New California Law: SB 9

What is SB 9 and how does this affect your property and neighborhood?

What

>> This law establishes a streamlined process to develop two primary residential dwelling units on one eligible single-family zoned parcel, and to split one eligible single-family zoned parcel into two separate parcels of approximately equal size. SB9 also provides more flexible property setbacks and parking standards and extends subdivision approval expirations for eligible parcels.

When

In effect, Jan 1, 2022. CA statewide law – Senate Bill 9 (SB9)

Why

To help address California’s housing shortage.

Where

Statewide. Single Family Zoning within Urban Area: Zones > R-1, RA, RB, RR.

Who

Eligible parcels must meet specific criteria:

>> Single-Family Zone within Urban Area

>> Not within protected resource areas

>> Consistent with Objective Standards

>> Demolition Restrictions – cannot demo affordable housing or rental housing, no more than 25% of exterior structural walls can be demoed if site has been a rental in the last 3 years.

>> Long Term Rental Requirement – If creating a rental – must be a long-term rental (over 30 days)

>> SB9 Land Divisions – Cannot do SB9 land division if parcels were created by SB9 lot split

>> Owner Occupancy – Required to occupy one of the lots as primary residence for minimum of 3 years

How

Review SB9 Eligibility Checklist

Review your project: Objective Standards Pre-Screen with County Planning

Submit an SB9 Application

*Learn more: Santa Cruz County Senate Bill 9

Approved parcel design options:

What does this mean and how does this affect you?

If you live in a typical residential zone, most likely, this means that you or your neighbors could be planning to build 2 primary dwellings on their property, with the added options of each having an ADU as well. If a parcel meets the criteria necessary for a project like this, there could be a number of added homes to residential neighborhoods.

Pros

More home options for our growing community.

More affordability for all. Supply/Demand.

Increased ease to build.

Added value to properties with more dwellings.

Cons

Potential increased construction noise around neighborhoods.

More cars, neighbors and traffic with added residences.

Less restrictive setbacks – added dwellings could be built closer to property lines potentially limiting privacy.

Potential smaller lots – changing the norm and conformity of certain neighborhoods.

Contact the County for specific questions about how this all works and/or how you could develop your property to take advantage of this new law:

https://www.sccoplanning.com/PlanningHome/ZoningDevelopment/SenateBill9.aspx

Jacqueline Van Metre

REALTOR, GREEN

David Lyng Real Estate

DRE 02015151

Be Water Smart

Be Water Smart

Smart ways to save more water in California

While California has seen a good amount of rain and snow so far this year, experts agree that it has not been enough to end our State’s long drought. So, all of us must keep doing our part to help save water. One of the best ways to do your part is to help waste less water and make water conservation upgrades in your home. It’s water smart, responsible, and can even make your home more valuable.

Water Use Facts

» Most water is wasted outside of the home. Landscaping generally accounts for the majority of household water use.

» You can save up to 24 gallons of water by using a full dishwasher versus washing dishes by hand.

» By turning off the faucet while you brush your teeth, you can save 8 gallons of water.

» 12.5 gallons, that’s how many gallons of water you save by taking a 5-minute shower versus a 10-minute shower.

» By using drought-resistant plants in your landscaping, you can save 30-60 gallons per 1000 sqft each time you water.

» Drip irrigation with a smart controller system can save you 15 gallons of water each time you water.

» Grass is the most water-demanding landscaping materials, eliminating lawns for drought-resistant plants instead is an excellent way to save water.

Saving Water Inside

♦ Fill the bathtub halfway or less > Filling up your bathtub halfway or less can save 17-25 gallons of water per bath!

♦ Install Aerators > Installing aerators can save .7 gallons per minute.

♦ Wash full loads of clothes and dishes > Washer: saves 15-45 gallons per load. Dishwasher: saves 5-15 gallons per load.

♦ When shopping for a new washing machine, compare resource savings among Energy Star models – some can save up to 20 gallons of water per load. Also, check the Consortium for Energy Efficiency website to compare the water use of various models.

♦ Be sure to test toilets for leaks periodically. One simple way is to put food coloring in the toilet tank; if it seeps into the bowl without flushing, there’s a leak. Also, check the toilet flapper; if it doesn’t close properly after flushing, it needs to be replaced.

♦ Take 5-minute showers > Keeping showers under 5 minutes can save 12.5 gallons per shower when using a water-efficient showerhead.

♦ Turn off the water when brushing teeth or shaving > By simply turning off the water when brushing your teeth or while shaving, you can save 8 gallons of water per person per day.

♦ You’ll want to upgrade older toilets, especially those installed before 1992, with water-saving WaterSense labeled models. High-Efficiency toilets can save 6-35 gallons per day.

♦ Consider installing dual-flush toilets with two flush options: a half-flush for liquid waste and a full-flush for solid waste.

♦ Check faucets and showerheads for leaks. One drip every second adds up to five gallons of water per day wasted. Leaks inside and outside the home can add up to 27-90 gallons of wasted water each day! Leaking devices should be replaced with new WaterSense labeled devices.

♦ Recycle indoor water and irrigate your garden > Collect water from your shower while it’s heating up with a watering can or bucket then use that water for your plants and outdoor needs, this can cut water use by 30%.

Saving Water Outside

♦ When upgrading landscape, consider xeriscaping, which depends on low-water-use plants. See homeowner landscape upgrade videos at: https://saveourwater.com/en/Upgrade-Your-Yard.

♦ Remember to spread two-to-four inches of organic mulch around plants, which helps them retain moisture and can save hundreds of gallons of water a year.

♦ Make sure to adjust sprinklers so that they water only the yard and not the house, sidewalk, or street.

♦ Drip irrigation for shrubs and trees that applies water directly to the roots, where it’s needed, is the best way to water these types of plants.

♦ Make sure clients check outdoor faucets, pipes, hoses, and sprinkler system valves for leaks, and that they keep sprinkler heads in good shape.

Jacqueline Van Metre

REALTOR, GREEN

David Lyng Real Estate

DRE 02015151

Beyond the Pre-Approval

Beyond the Pre-Approval

Things to keep in mind as you are preparing to purchase your next home.

In a competitive market it pays to be prepared for the wonderful adventure of home buying!

Many home buyers make the mistake of moving their money around while shopping for a home, which leads to unexpected issues for them; such as buying a new car and taking out a new loan, carrying low level debts that could be paid off easily, changing jobs or opening a new credit card. Other common mistakes range from trying too hard to time the market looking for the “best” deal and letting that “really amazing house” get away and by not factoring in the neighborhood and/or the future life of your dream home. Remember that you’ll most likely own your home for several years, if not several decades, think about your plans for the future and how well your home will work for you. These tips should help you become a much more savvy buyer and put you in a solid position to feel great about your home purchase.

Keep Your Money Where it is

It’s not wise to make any huge purchases or move your money around three to six months before buying a new home.

You don’t want to take any big chances with your credit profile. Lenders need to see that you’re reliable and they want

a complete paper trail so that they can get you the best loan possible. If you open new credit cards, amass too much

debt or buy a lot of big-ticket items such as a car or new furniture, you’re going to have a hard time getting a loan.

Don’t Try to Time the Market

Don’t obsess with trying to time the market and figure out when is the best time to buy. Trying to anticipate the housing

market is impossible. The best time to buy is when you find your perfect house and you can afford it. Real estate is

cyclical, it goes up and it goes down and it goes back up again. So, if you try to wait for the perfect time, you’re

probably going to miss out.

You’re Buying a House – Not Dating it

Buying a house based on emotions is just going to break your heart. If you fall in love with something, you might end up

making some pretty bad financial decisions. There’s a big difference between your emotions and your instincts. Going

with your instincts means that you recognize that you’re getting a great house for a good value. Going with your

emotions is being obsessed with the paint color or the backyard. It’s an investment, so stay calm and be wise.

Research the Neighborhood

Before you buy, get the lay of the land – drop by morning noon and night. Many home buyers have become completely

distraught because they thought they found the perfect home, only to find out the neighborhood wasn’t for them. Drive

by the house at all hours of the day to see what’s happening in the neighborhood. Do your regular commute from the

house to make sure it is something you can deal with on a daily basis. Find out how far it is to the nearest grocery store

and other services. Even if you don’t have kids, research the schools because it affects the value of your home in a very

big way. If you buy a house in a good school district versus bad school district even in the same town, the value can be

affected as much as 20 percent.

Think Long-Term & Think Re-Sale

Are you planning to have kids? Will you be taking care of elderly relatives? You might be planning to live in your first

home for only a few years. In that case, who is your target audience when it comes time to sell the house? If you buy a

house in a very bad school district or a house on a very busy street, when you are ready to sell the house, most families

with children will be out of your list of potential buyers.

Look at All the Expenses when Budgeting

When budgeting for the house, don’t stop with principal, interest, taxes and insurance; add in utilities, cost of commuting,

HOA dues, property taxes, maintenance costs, and upgrades. Call the utility companies that service the house you are

considering and ask for an estimate of what the cost will be, whether there are any budget plans available, etc. Will the

gas budget for your car go up if you are moving further away from the places you frequently visit? Budget all of these

expenses and see if you can still afford the house. Your Realtor can help you estimate these costs for your area.

Look Beyond the Staging

The psychology of staging a home really works; staged houses look far better than houses that are still being occupied

or are completely vacant. For example a house might have nightstands with lamps next to the bed that really increase

the appeal of the room. In reality, though, there may not be plug points anywhere near the lights. So practically that

setup would not be possible without remodeling. When you are considering a house, mentally try to remove the staging.

Pay more attention to the layout of the house and the structure itself. Ugly wallpaper and paint can be easily fixed later.

Try Not to Buy the Most Expensive Home on the Block

When a wise man once said to never buy the most expensive house on the block, he was talking about appreciation.

Over time, home values in a neighborhood tend to even out. So if you have the most expensive home, its value won’t

increase as much as will a low- to mid-priced home in the same neighborhood. If you want to get the most bang for

your housing buck, buy a less expensive model on the best block you can afford. Remember, location is the one thing

you can’t change. So, if you are buying the least expensive house on the street in a good location, the value has nowhere

to go but up.

Call me to dive deeper into these tips, I’m here to help.

Jacqueline Van Metre

REALTOR, GREEN

David Lyng Real Estate

DRE 02015151

When to Start Touring

Buyers: When to Start Touring

So you’re ready to see some houses for sale?! Make sure you are really ready before you head out the door with these steps

As a home buyer in a competitive time, it pays to be prepared before diving in the deep end and getting ahead of yourself.

Many home buyers make the mistake of home touring before they’re truly ready and have their hearts utterly broken by not being qualified for the home they love or end up in a rushed transaction by working with pushy lenders, sellers or agents or even end up with buyer’s remorse because they didn’t do enough homework on the house.

1. Understanding Your Budget

Buying a home of any type and any size is one of the largest purchases a person generally makes in their lifetime. You have to take some time to understand your current financial situation and obligations first. Review your household income, debts, upcoming expenses, and your savings plan to see where you stand.

You can also check out this mortgage calculator to get a rough estimate of a monthly mortgage payment:

https://jacquelinevanmetre.com/financial-calculators

2. Gather Your Down Payment

This is common questions, how much down payment will I need to buy a house? Normally a buyer will need between 3.5% – 20% of the purchase price ready for their down payment. They will also need an extra 1%-3% available for closing costs. Plus, moving expenses, inspection fees, immediate renovation costs, etc…

3. Find The Right Realtor

This is a must-have; you’ll want to have a trusted professional in your corner during this process. Realtors act as advisors, a resource and as your representative looking out for your best interests. They also will negotiate on your behalf and can help with local knowledge of a city’s restrictions or requirements as a new homeowner. Remember, a Seller’s agent represents the Seller, a Buyer’s agent represents you, the Buyer.

*You have found the right Realtor – it’s me! 🙂

4. Get Pre-Qualified (or even better) Pre-Approved

Now is the right time to discuss your housing goals with your lender and get pre-qualified. Your Realtor can help you get started if you’ve never worked with a lender before. I have a list of trusted lenders that I have worked with in the past that I can share with you. It is always recommended to talk to 2 or more lenders to see what type of loans and rates they can offer you for your specific circumstances. Every lender is a little different. Once you are Pre-Qualified for a loan you will know exactly how much home you can afford.

5. Start Touring Homes!

Now that you have all your ducks in a row, it’s time to start touring homes! We’ll discuss your wish list for your home, what neighborhoods you like best and what your ideal timeframe for moving is. Then we will tour all the homes that you’re interested in. This is the fun part!

For more information about any steps in this process, reach out to me to discuss.

Let’s get started today!

Jacqueline Van Metre

REALTOR, GREEN

David Lyng Real Estate

DRE 02015151

Pre-Approved vs. Pre-Qualified

What is the difference between being Pre-Approved vs. Pre-Qualified

A breakdown to help you understand the important differences

What is the difference between getting Pre-Approved vs. Pre-Qualified? A pre-qualification is a good indication of creditworthiness and the ability to borrow, but a pre-approval is your verified data—for example, a credit check; it is the definitive word and is much more involved.

Most real estate buyers have heard that they need to be pre-qualified or pre-approved for a mortgage (your home loan) if they’re looking to buy a property. These are two key steps in the mortgage application process. Some people use the terms interchangeably, but there are important differences that every homebuyer should understand.

Pre-qualifying is just the first step. It gives you an idea of how large a loan you’ll likely qualify for. Pre-approval is the second step, a conditional commitment to actually grant you the mortgage.

Key Takeaways

-

Pre-qualification is based on data the borrower submits to a lender, which will provide a ballpark estimate of how much they can borrow.

-

The pre-qualified amount isn’t a sure thing, because it’s based only on information provided.

-

The lender won’t take a close look at a borrower’s financial situation and history to determine how much mortgage they can reasonably afford until they reach the pre-approval stage.

-

The borrower receives a conditional commitment in writing for an exact loan amount after they’ve been pre-approved.

Pre-Qualified

Getting pre-qualified involves supplying a bank or lender with their overall financial picture, including debt, income, and assets. The lender reviews everything and gives an estimate of how much the borrower can expect to receive. Pre-qualification can be done over the phone or online, and there’s usually no cost involved.

Pre-qualification is quick, usually taking just one to three days to get a pre-qualification letter. Keep in mind that loan pre-qualification does not include an analysis of credit reports or an in-depth look at the borrower’s ability to purchase a home.

The initial pre-qualification step allows for the discussions of any goals or needs regarding a mortgage. The lender will explain various mortgage options and recommend the type that might be best suited.

Again, the pre-qualified amount isn’t a sure thing, because it’s based only on the information provided. It’s just the amount the borrower might expect to get. A pre-qualified buyer doesn’t carry the same weight as a pre-approved buyer, who has been more thoroughly investigated.

Pre-Approved

Getting pre-approved is the next step, and it’s much more involved. “A pre-qualification is a good indication of creditworthiness and the ability to borrow, but a pre-approval is the definitive word,” says Kaderabek.

The borrower must complete an official mortgage application to get pre-approved, as well as supply the lender with all the necessary documentation to perform an extensive credit and financial background check. The lender will then offer pre-approval up to a specified amount.

Going through the pre-approval process also offers a better idea of the interest rate to be charged. Some lenders allow borrowers to lock in an interest rate or charge an application fee for pre-approval, which can amount to several hundred dollars.

Lenders will provide a conditional commitment in writing for an exact loan amount, allowing borrowers to look for homes at or below that price level. This puts borrowers at an advantage when dealing with a seller because they’re one step closer to getting an actual mortgage.

Keep in mind that you don’t have to shop at the top of your price range. Depending on the market, you might be able to get into a home you like for less money than you’re approved for, leaving you with extra cash each month to set aside for home repairs, retirement, kids’ college funds, or checking something off your bucket list.

Key Differences

Below is a quick rundown of how pre-qualification and pre-approval differ.

Pre-Qualified = Pre-Q | Pre-Approved = Pre-A

Do I need to fill out a mortgage application?⠀⠀⠀

Pre-Q: No | Pre-A: Yes

Do I have to pay an application fee?

Pre-Q: No | Pre-A: Maybe

Does it require a credit history check?

Pre-Q: No | Pre-A: Yes

Is it based on a review of my finances?

Pre-Q: No | Pre-A: Yes

Does it require an estimate of my down payment amount?

Pre-Q: No | Pre-A: Yes

Will the lender give me a specific loan amount?⠀

Pre-Q: No | Pre-A: Yes

Will the lender give me interest rate information?

Pre-Q: No | Pre-A: Yes

Take Away:

Be sure you’re Pre-Approved by your lender before touring properties and falling in love with a home otherwise your offer will probably not be considered at all!

If you need a list of great lenders in our area please ask me for my favorites that I have had a excellent experience working with in the past.

Jacqueline Van Metre

REALTOR, GREEN

David Lyng Real Estate

DRE 02015151

DIY Home Inspection Checklist

Follow This DIY Home Inspection Checklist Before Making an Offer

Your guide to confidently complete a full DIY home inspection

When buying a home, consider a DIY home inspection before making an offer. In a fast-paced market (like it is currently!) your first tour might very well be your only tour before making an offer on the house.

This is not to say that you shouldn’t get a home inspection from a licensed professional. I highly recommend a professional home inspection as well as a pest inspection before purchasing any home. In fact, many sellers have already had these 2 inspections done before they list the home, make sure you take the time to review these reports and ask questions! A DIY walk through can help give you a better idea of what condition the home is in and what repairs to expect —if you know what to look for. After doing your own inspection, follow up with an experienced pro – calling the pros who know the home to discuss your findings and any questions you have is always a great idea. That way, you’ve covered all your bases.

What is a DIY home inspection, and why should I do one?

During a DIY home inspection, you take a good look at the interior and exterior of the property to make sure everything is in working order. A thorough inspection will cover everything from the windows, plumbing, outlets and water heater to the walls, roofing, and more. Everything on the property should be looked at.

Because of all the work involved, getting a home inspection is an important part of the home buying process. Doing a DIY home inspection is a great idea as an initial step. It gives you a hands-on appreciation for your potential new home while learning about everything it has to offer. Sometimes the beauty (or ugliness) of a home can make you overlook items you aren’t excited about repairing. It also helps you save money if you aren’t completely sold on a house or if you aren’t close to the end of the overall process.

Luckily, doing home inspections doesn’t require tons of training or special paperwork. All you really need is a notebook, pen, marble, and this checklist. If you’re feeling ambitious, take a tape measure. Although not every aspect of this list will apply to all homes, this is a rather inclusive inspection list that will be a good jumping off point in your due diligence.

General items to inspect

- Windows: Check that they open and close easily and for any broken panes. Check thoughout the entire house as windows could be different ages and made from different material. For example, are they vinyl, wood, aluminum? Make sure you know the answer to this question for each window.

- Doors: Check that they open and close completely. Do they stick? Lock? Scrape the floor at any point?

- Floors: Check for any creaking and unevenness. Place a marble on the floor and see if it rolls to check for a slant. This test should be done in multiple areas of the home to make sure everything is level.

- Walls: Check for any holes or cracks in the walls. It’s also important to check the insulation. Touching different areas of the walls can be a good way to check for cold spots. Cold spots are an indication that the home isn’t properly insulated.

- Trim: Is there any damage or missing pieces? Animals, for example, can be brutal to wood trim, and matching old trim is almost impossible. If there is damage, it may make sense to replace the trim completely.

- Lights: Turn on every light switch to make sure they work. Check with the power company about this step if need be.

- Stairs: Walk up and down the stairs and touch every spindle on the railing. Do they seem sturdy or wobbly? Do the stairs creak and are any parts missing? Be aware that uneven stairs can be dangerous.

- Outlets: Get a voltage tester at your local big box home improvement store for less than $20 and test every single outlet both inside and outside. Get a ground fault circuit interrupter, or GFCI, to prevent electrocution when testing voltage.

- Furnace: Look for any stickers on the furnace that indicate the installation date. If there is none, make sure to get this information as soon as possible and store it in a safe place.

- Water heater: Check for water around the base of the water heater for damage or other signs of wear. The heater should also have stickers that indicate the installation date.

What to look for in the kitchen

- Cabinets and drawers: Open and close every cabinet and drawer to make sure they move smoothly and that they don’t prevent access to anything.

- Oven: Open the oven door slowly to make sure the springs work and the light, if it has one, turns on appropriately. Turn it on to make sure it still works and is in good condition.

- Stove: The same thing applies to the stove. Turn on each burner to make sure it works. If gas, turn on and off one burner before turning the next one on to make sure they all turn on by themselves, rather than catching the flame from an adjacent burner. If they all work individually, turn them all on to make sure they all work at the same time. If electric, just turn them all on.

- Fridge: Open the refrigerator and freezer doors to ensure they open easily. However, do NOT do this if the home is vacant and appears to have been vacant for some time. Who knows what could be in there after all that time— and it could be dangerous. If it’s been an extended period of time, it’s safer to replace the fridge.

- Dishwasher: Open and inspect the dishwasher slowly to check the springs on the door. If it’s electronic, make sure the unit still turns on and functions as it’s meant to.

- Faucet: Run the water to check the pressure and make sure the knobs completely turn off.

- Garbage disposal: Make sure it runs, turning the water on beforehand.

- Cabinet interiors: Take a look inside of each one to make sure they are spacious enough. And make sure there are enough drawers to fit your needs.

- Microwave: Make sure it works. Turn it on and press some buttons.

- Hood: Turn on the range hood fan and light to make sure they work. Peek underneath to check for filth—a commonly overlooked area for cleaning.

- Countertops: Check here for chips and cracks regardless of what it’s made out of.

- Tile: Check the floor for cracked or broken tiles.

Bathroom inspection must-dos

- Plumbing and drainage: Flush the toilet and let the water run in the sink and tub. Inspect that the water in the sink and tub drain properly. Turn on the shower and make sure the water runs evenly with good pressure. This is also a great opportunity to check for pipe leaks and functioning knobs.

- Flooring: Any broken tiles?

- Toilet: Does it rock or is it solidly on the floor? Make sure it flushes properly and doesn’t run after the fact.

- Tub: Check for cracks, chips, and any spaces between the tub and the walls or the floor.

- Vanity: Check the overall condition and each storage space. If there’s a mirror, make sure it isn’t cracked, chipped, or broken.

- Ventilation: Does the fan work? Is there a window and does it open and close easily?

Quick bedroom checks

- Closets: If the closets have doors, make sure they open and close easily.

- Flooring: Does the carpet have stains, wear spots, or other kinds of damage? With wood and tile, does it have any scratches, cracks, or broken places?

Living, dining, and family room scan

- Doors: Any doors? Do they open and close easily?

- Flooring: What is the state of the flooring?

- Walls: Are there any holes or other damage in the walls?

- Ceilings: Make sure they don’t have any cracks or holes. These would also be a big issue if there’s an attic that you plan to use.

Attic inspection

- Access: It’s important to know how to get into the attic. Some have drop-down ladders or stairs with doors. However you get into it, make sure it’s safe and that each door opens easily.

- Insulation: A lot of attics give easy access to the state of the home’s insulation. It may be the only place in a home where the insulation is exposed, which makes it the easiest place to inspect it and check that there is enough for your needs.

- Ventilation: The attic may also be one of the only areas to see a home’s ventilation. Make sure it’s properly ventilated and that there are no areas for moisture to get trapped, which allows dreaded mold to grow.

- Framing: The framing can also be exposed in an attic. Check to see if it’s cracked or chipped or has any loose spots.

Basement/Crawlspace deep dive

- Odor: Basements are typically underground so make sure there’s no strange odor. An overpowering or strange odor can be mold or mildew.

- Walls: Do the walls have any cracks? Small, hairline cracks are not so concerning, but large cracks—especially horizontal cracks—can be an indicator of bigger foundation problems. Water stains may also indicate former flooding or leaky foundations.

Examine the exterior

- Sprinklers: Turn on the sprinkler system to test the water pressure and that the system works the way it’s meant to.

- Walkways: Uneven walkways can be dangerous. Make sure there are no serious cracks, holes, etc.

- Lights: Flip them on and test them out to make sure they stay on consistently. If they are motion-sensor lights, test them out by walking by them.

- Fence: Walk the fence to check for loose boards and the overall sturdiness.

- Siding: Check for any decay and wood rot that may become a bigger problem as time goes on. Look at the mortar between the bricks, if applicable. Is it cracking? How badly?

- Roof: Go to the south side of the house and look at the shingles. (It gets the most sun.) Curling or buckling can be an indication that the roof needs work.

- Gutters: The gutters are considered part of the roof. It’s important to make sure they don’t have any rust or cracks and holes that would make them leak. The downspouts should also be a certain distance away from the house’s foundation, and the gutters should be a certain size to prevent runoff.

- Garage door: Make sure the garage door(s) open and close easily. If there’s a remote, make sure it works properly.

- Driveway: Check for significant cracks or holes and note the material the driveway is made of to be able to estimate repairs or replacement costs. Is it asphalt? Is it concrete? Is it brick?

- Lawn: Look at the grass and check for dead patches.

- Yard: Note the state of the yard, and make sure there aren’t any dead trees. How’s the size? What amount of shade/sun does it get (for those considering gardens or needing to plant grass). Is there any standing water?

- Air conditioning: Is there an AC unit? If not, then does it have a line set to a furnace, and the AC has been stolen? Or is there simply no line to the furnace? Does the house have some or several window AC units? This is a good indication (but not a confirmation) there isn’t a setup for the outside unit. If it doesn’t have those lines/power supply, make sure you account for that in your figures. There is definitely an additional cost for the line set. Also, ensure you have the right refrigerant for the AC you have.

- Chimney: Check to make sure the chimney is clean and ask if firewood can be burned safely.

Pro-Tip >> Take photos & ask your agent lots of questions. My buyers are often concerned that they are asking me too many questions and apologize for it. To help with these feelings I’ll let you know here that helping you understand everything during this process is a huge part of my job, it’s 100% OK to ask me lots of questions.

Good luck DIYers!

Jacqueline Van Metre

REALTOR, GREEN

David Lyng Real Estate

DRE 02015151

* Originally published 4.21.21 https://www.biggerpockets.com/blog/diy-home-inspection

Save More Money

Save More Money

Tips on how to save more money for a down payment

Saving up for a down payment for a new home is without a doubt the most difficult part for most home buyers. Life is increasingly expensive, especially here on the coast of California. Every percentage more you are able to put down on your home purchase will save you a ton of money in interest and PMI (private mortgage insurance). It’s absolutely worth it to start stashing cash and finding new ways to save more money and work towards that big goal of a new home!

1. Don’t Waste Food & Toss Out Money

Meal plan and eat everything you purchase at the grocery store

Think about how much food you toss out every week or so? Is it quite a bit? Very little? Good for you if you already meal plan and try to waste as little as possible already! If this is an area where you could improve, a great new motivator could be how much money you could be saving and putting towards something you really want – like that house with the yard and the extra bedroom! Meal planning is key here: make a list and try not to stray. Then the trick is to eat what you purchase, especially the perishables. My family has mastered this by including an “everything goes in” meal we make every week or 2. A casserole, a quiche, a curry, even spaghetti – whatever veggies are getting close to end of life we chop them up and include them into this “everything” meal. We’ve come up with a lot of unlikely, but yummy combinations too!

2. Pay Yourself First

Save a set amount of money from every paycheck or every week, set this up so it’s automatic! If it’s not in your checking account, odds are you won’t spend it.

This is an oldie, but goodie. I have a few strategies for this tip. The first is to save a set percentage from every paycheck, I do this as soon as my paycheck hits my checking account. Taking the money immediately out of your checking account to your savings is the best way I’ve found to forget about the money all together! (But it’s there when I need it and that’s the best part.) The second is to set up a reoccurring savings transfer. I have my saving accounts set up for a bimonthly transfer of money, it’s not a large sum of money, but enough to add up over time. Watch your saving accounts grow over the years, it’s both surprising and exciting!

3. Unsubscribe From Retail Emails

Those ads are just tempting you to buy more stuff you don’t need.

How many daily temptations do we see everyday to purchase “stuff”? Ads on TV, coupons in the mail, ads in your email, ads on social media, ads in the paper… they are everywhere! You probably do not really need anything being marketed to you either, especially not at the rate they are popping up distracting us from our ultimate goal of a larger savings account. Ads can be very difficult to ignore so take back some control and unsubscribe from most, if not all, of those emails. You’ll thank yourself for it later.

4. Cancel Subscriptions & Apps You Don’t Use/Need Anymore

These tend to get forgotten over time.

These are so easy to forget about and they can seriously add up! Apps and subscriptions to things such as magazines, streaming services, mail order clothing/food often go unnoticed after awhile since they are set up on auto-pay. Take a moment and take inventory of these types of subscriptions and apps you pay for. Are there any you don’t use anymore? Cancel them and find freedom in unburdening yourself from that bill and saving that extra money every month!

5. Pay Off Loans With The Heaviest Interest Rates First

Student loans? Credit cards? Carrying debt with high interest rates is costing you a lot of money.

These “heavy-hitters” are bogging you down and costing you a ton of money every month/year. This was a major lesson I learned several years ago. I had some money earning a very small amount of interest in a savings account. I also had about the same amount of student loan debt, which had interest rates of 6.5%-12%. Once I became aware of the fact that I was paying far more in interest on those loans than my savings account generated – therefore costing me money, I took all of my savings and paid off all of my student debt! It was freeing and such a great decision for the long haul. Figure out what is costing you the most money in interest and pay those debts off as soon as you can. These are generally student loans and credit cards. Try to avoid carrying this type of debt altogether.

Enjoy all the extra money you find! Please share any additional money saving tips you use.

Jacqueline Van Metre

REALTOR, GREEN

David Lyng Real Estate

DRE 02015151

Getting Involved

Getting Involved

How to get started and where to volunteer?

Feeling part of the greater community is a breath of fresh air, not only for those you are helping, but for you as the volunteer as well. It’s scientifically proven that giving provides more endorphins than receiving. So it’s a true win-win for everyone when you volunteer for something you’re passionate about.

Volunteering can feel intimidating for some and it can be difficult to know who needs help and what you can do. We all have our own unique skills and interests so the best place to start is accessing what you feel a pull towards, a passion, or something relative to your life then focus on those types of organizations and volunteer needs.

If your heart is in the right place to start with then the efforts and hours you’re giving won’t feel like work at all!

Follow your instincts and determine what you have a passion or interest in.

There are volunteer needs for just about everything you can think of!

Think about your skills – Are you Handy? Creative? Outdoorsy? People-oriented? Organized? Social Media gifted? A Writer? Strong? Full of Energy? Patient? A good Listener? These are all great skills different organizations could benefit from.

Below is a list of Local Organizations in Santa Cruz I created – most of which I have personally worked with – to help get your volunteer-juices flowing.

MBOSC – Mountain Bikers of Santa Cruz – MBOSC.org

For the Trail-users and outdoorsy types

Are you a hiker, biker, horseback rider or trail jogger in Santa Cruz? If so, you’d undoubtedly enjoyed the incredible trail system that Santa Cruz County has to offer. Our community is unique to have such an expansive array of mixed-us trail options from the cliffs to the mountain peaks all around us. MBOSC was founded in 1997 to support, preserve, and expand sustainable trail access in the Santa Cruz area and beyond. With educational seminars, trail work opportunities, DIG days (these days are a lot of work, but are really fun too!), mountain biking races and more, this organization is an excellent opportunity to support a local nonprofit and truly give back to the community.

Santa Cruz SPCA – SPCASC.ORG & Santa Cruz County Animal Shelter – SCANIMALSHELTER.ORG

For the Animal-Lovers, Organized and People-Oriented types

Every community has it’s set of animal shelters & it’s share of animal lovers too! These two organizations are unbelievably hardworking, passionate and full of wonderful ways to give back to our furry friends. These organizations both have volunteer needs ranging from office work, photography, adoptions, fostering, vet services, youth programs, events, community outreach, teen programs, animal care and beyond.

The Santa Cruz SPCA is a locally ran non-profit dedicated to the welfare of animals in the community. They receive no government funding and depend solely on the community to remain in operation. I personally volunteer as a photographer and foster here and support this organization whole-heartedly. The SPCA mainly fills the need as an overflow animal shelter for our community and others. With their much-needed brand new shelter nearly finished, their needs will soon dramatically expand if you are looking to volunteer!

The Santa Cruz County Animal Shelter has an open-door program and is the main animal focused resource for the entire County. From drop-offs, adoptions, licensing, disaster pet care, low cost vet services, pet food pantry, community outreach, humane education, complaints and reports of abuse/neglect, wildlife issues plus more! With no animal ever being turned away and so many responsibilities, this shelter is highly effective and can always use an extra set of hands.

Save Our Shores – SAVEOURSHORES.ORG

For the Beachcombers, outdoorsy, ocean-saving types

Save Our Shores is a dedicated organization focused on advocating, supporting and keeping our coastline healthy and clean.

“From policy change to educational programs, we’re ensuring ocean conservation throughout the community. Our programs and projects are designed to support the foundations of a thriving Monterey Bay: clean shores, healthy habitats, and living waters.”

Save Our Shores offers beach day cleanups, educational seminars and other local events. If you love the Monterey Bay, spend a day or two out on the beach helping their efforts – this a low commitment volunteering gig, great for all ages!

Habitat for Humanity Monterey Bay – HABITATMONTEREYBAY.COM

For the Handy & Project-oriented types

“Habitat for Humanity Monterey Bay is an independent locally operated and funded affiliate of Habitat for Humanity International. Our mission is to build decent, affordable homes and provide home ownership opportunities to qualified families who live and work in Santa Cruz and Monterey Counties.”

This organization is dedicated to helping hard-working homeowners in need of home repair assistance in a variety of ways, keeping people in their homes and helping new families create a home out of a home in disrepair. As a volunteer you could assist with construction projects, help at their store or with office work, or get involved with their community events!

Santa Cruz Volunteer Center – SCVOLUNTEERCENTER.ORG

For the Community-minded, Patient, People-Oriented & Organized types – there’s something for everyone here!

The Santa Cruz Volunteer Center is a place where Nonprofits in the entire county can ask for volunteer help for just about anything! Ranging from the recent fire evacuation centers to holiday help, and from food delivery to helping seniors, the tasks listed are based on needs in the community at any given time. This is a great place to start if you’re looking for an easy way to try out a new volunteer role or organization.

Enjoy getting involved and giving back!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link