Understanding CA Prop 19

Benefits for homeowners & how this changed property taxes

If you purchased your home more than 5 years ago, you likely have a good deal of money in equity now. Additionally, due to the purchase price of your home, your property taxes are significantly lower than they would be if you purchased your home again today. While some people can and prefer to stay in their homes forever, for others it makes sense to sell their property and move elsewhere.

Many people find they would like to live closer to family and loved ones once they don’t need to worry about working and commuting any longer. Others don’t want to take care of their large home once the kids are no longer living there. I’ve also seen people make exciting plans to travel the world and leverage their home’s value to fund their new lifestyle.

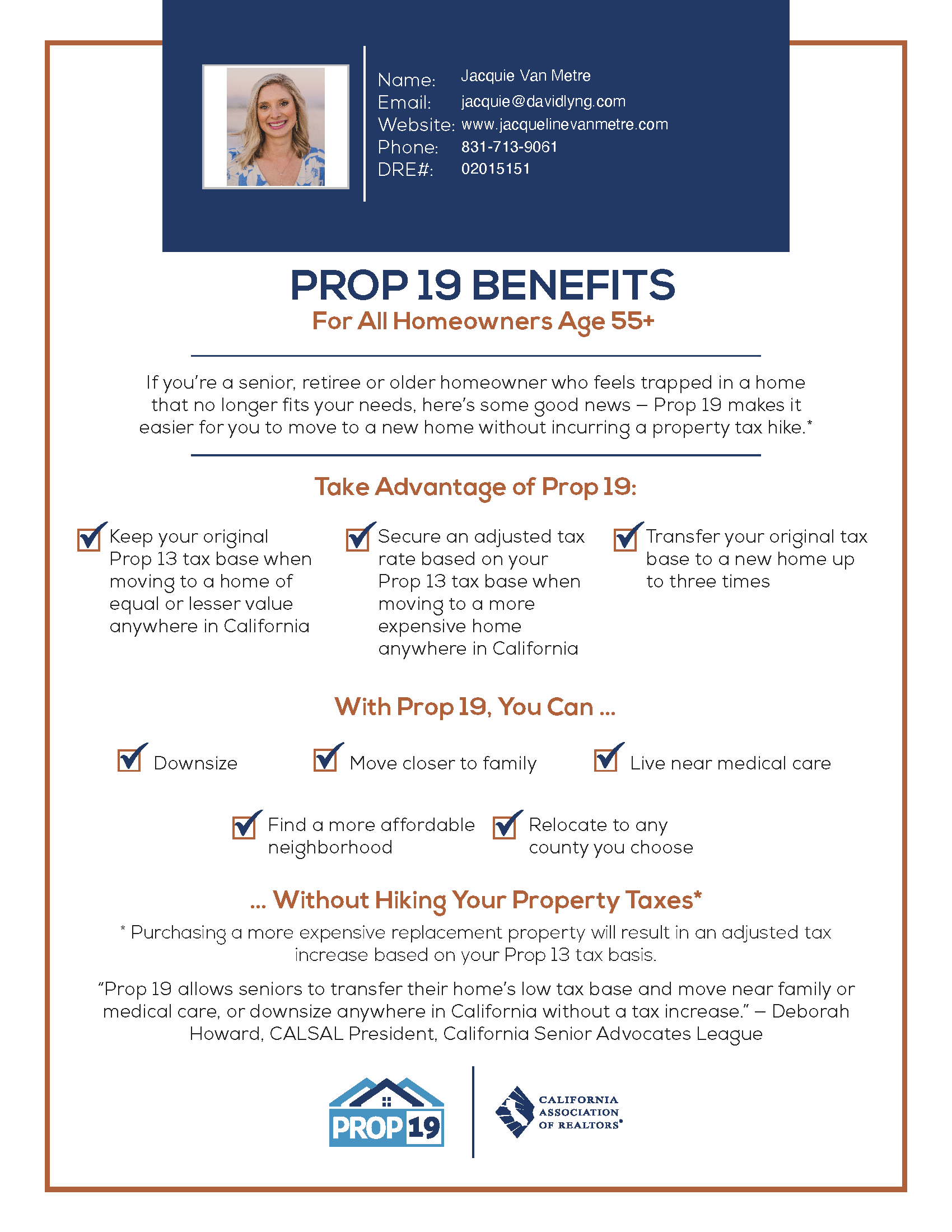

Prop 19 can help with all of these goals if you qualify. Take advantage of your new property tax benefits when you transfer your tax basis!

How Prop 19 impacts the taxes on the properties you have inherited:

If you have recently inherited a home, or you will soon, under Prop 19 the property taxes will increase to match the property’s current market value.

To avoid the increase in property taxes at the inherited property, you have 2 options:

-

- Within 1 year of transfer, live at the property as your primary residence and file for the appropriate exemption.

- Sell the property.

For additional information about how Prop 19 works please email me: jacquie@davidlyng.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link